Year to date summary:

- GAAP revenue increased 12% and operating income increased 23% for the six months ended

December 31, 2021 compared to the prior-year period. - Non-GAAP adjusted revenue increased 10% and non-GAAP adjusted operating income increased 15% for the six months ended

December 31, 2021 compared to the prior-year period.1 - GAAP EPS was

$2.68 per diluted share for the six months endedDecember 31, 2021 , compared to$2.13 per diluted share in the prior-year period. - Cash at

December 31, 2021 was$29.1 million and$147.8 million atDecember 31, 2020 . - Debt related to the revolving credit line was

$240 million atDecember 31, 2021 and zero atDecember 31, 2020 .2

Second quarter summary:

- GAAP revenue increased 17% and operating income increased 34% for the quarter compared to the prior-year quarter.

- Non-GAAP adjusted revenue increased 11% and non-GAAP adjusted operating income increased 13% for the quarter compared to the prior-year quarter.1

- GAAP EPS was

$1.30 per diluted share for the quarter, compared to$0.94 per diluted share in the prior-year quarter.

Full-year fiscal 2022 guidance:

- GAAP revenue

$1,939 million to$1,942 million - GAAP EPS

$4.75 to$4.82 - Non-GAAP revenue

$1,889 million to$1,892 million 3

According to

|

1 |

See tables below reconciling non-GAAP financial measures to GAAP. |

|

2 |

The change in borrowings was primarily a result of the Company's repurchases of common stock during the trailing twelve months. |

|

3 |

See tables below reconciling fiscal year 2022 GAAP to non-GAAP guidance. |

|

4 |

See tables below on page 10 reconciling Net Income to non-GAAP EBITDA. |

Operating Results

Revenue, operating expenses, operating income, and net income for the three and six months ended

|

(Unaudited, in thousands) |

Three Months Ended |

% Change |

Six Months Ended |

% Change |

|||||||

|

2021 |

2020 |

2021 |

2020 |

||||||||

|

Services and support |

$ 296,211 |

$ 250,873 |

18 % |

$ 593,704 |

$ 531,870 |

12 % |

|||||

|

Percentage of total revenue |

60 % |

59 % |

60% |

61% |

|||||||

|

Processing |

197,685 |

171,488 |

15 % |

388,248 |

342,291 |

13% |

|||||

|

Percentage of total revenue |

40 % |

41 % |

40% |

39% |

|||||||

|

REVENUE |

$ 493,896 |

$ 422,361 |

17 % |

$ 981,952 |

$ 874,161 |

12% |

|||||

- Services and support revenue increased for the second quarter, primarily driven by growth in deconversion fee revenue of

$24,748 . Other increases were data processing and hosting fees, implementation, and conversion/merger revenues. Processing revenue increased for the second quarter, primarily driven by growth in card processing fee revenue of 14%. Other increases were in Jack Henry digital and remote capture and automated clearinghouse (ACH) revenues. - Services and support revenue increased for the year-to-date period, primarily driven by growth in data processing and hosting fee revenue of 12%. Other increases were deconversion fee, implementation, and software usage fee revenues. Processing revenue increased for the year-to-date period, primarily driven by growth in card processing fee revenue of 12%. Other increases were in remote capture and ACH, and Jack Henry digital revenues.

- For the second quarter, core segment revenue increased 15%, payments segment revenue increased 18%, complementary segment revenue increased 17%, and corporate and other segment revenue increased 36%. Non-GAAP adjusted core segment revenue increased 7%, non-GAAP adjusted payments segment revenue increased 13%, non-GAAP adjusted complementary segment revenue increased 11%, and non-GAAP adjusted corporate and other segment revenue increased 36% (see revenue lines of segment break-out tables on page 4 below).

- For the year-to-date period, core segment revenue increased 11%, payments segment revenue increased 13%, complementary segment revenue increased 12%, and corporate and other segment revenue increased 18%. Non-GAAP adjusted core segment revenue increased 8%, non-GAAP adjusted payments segment revenue increased 11%, non-GAAP adjusted complementary segment revenue increased 10%, and non-GAAP adjusted corporate and other segment revenue increased 18% (see revenue lines of segment break-out tables on page 5 below).

|

(Unaudited, in thousands) |

Three Months Ended |

% Change |

Six Months Ended |

% Change |

||||||||

|

2021 |

2020 |

2021 |

2020 |

|||||||||

|

Cost of revenue |

$ 282,825 |

$ 257,782 |

10 % |

$ 559,460 |

$ 520,711 |

7% |

||||||

|

Percentage of total revenue |

57 % |

61 % |

57% |

60% |

||||||||

|

Research and development |

29,916 |

26,780 |

12 % |

56,670 |

52,837 |

7% |

||||||

|

Percentage of total revenue |

6 % |

6 % |

6% |

6% |

||||||||

|

Selling, general, and administrative |

55,493 |

44,167 |

26 % |

106,565 |

89,393 |

19 % |

||||||

|

Percentage of total revenue |

11 % |

10 % |

11 % |

10 % |

||||||||

|

OPERATING EXPENSES |

368,234 |

328,729 |

12 % |

722,695 |

662,941 |

9% |

||||||

|

OPERATING INCOME |

$ 125,662 |

$ 93,632 |

34 % |

$ 259,257 |

$ 211,220 |

23% |

||||||

|

Operating margin5 |

25 % |

22 % |

26% |

24% |

||||||||

- Cost of revenue increased for the second quarter and year-to-date period, primarily due to higher costs associated with our card processing platform, personnel costs, and operating licenses and fees.

- Research and development expense increased for the second quarter and year-to-date period, primarily due to higher personnel costs (net of capitalized personnel costs).

- Selling, general, and administrative expense increased for the second quarter and year-to-date period, primarily due to higher personnel costs and a smaller gain on sale of assets in the current fiscal periods.

|

5 Operating margin is calculated by dividing operating income by revenue. |

|

(Unaudited, in thousands, except per share data) |

Three Months Ended |

% Change |

Six Months Ended |

% Change |

|||||||

|

2021 |

2020 |

2021 |

2020 |

||||||||

|

Income before income taxes |

$ 125,221 |

$ 93,567 |

34 % |

$ 258,574 |

$ 211,105 |

22 % |

|||||

|

Provision for income taxes |

29,551 |

21,585 |

37 % |

60,791 |

47,907 |

27 % |

|||||

|

NET INCOME |

$ 95,670 |

$ 71,982 |

33 % |

$ 197,783 |

$ 163,198 |

21% |

|||||

|

Diluted earnings per share |

$ 1.30 |

$ 0.94 |

38 % |

$ 2.68 |

$ 2.13 |

25% |

|||||

- Effective tax rates for the second quarter of fiscal years 2022 and 2021 were 23.6% and 23.1%, respectively. Effective tax rates for the year-to-date period of fiscal years 2022 and 2021 were 23.5% and 22.7%, respectively.

- The Company repurchased 1.25 million shares of common stock during fiscal year-to-date 2022 and 675 thousand shares of common stock during fiscal year-to-date 2021. Common stock repurchases during the trailing twelve months contributed

$0.05 to diluted earnings per share for the second quarter and$0.09 for year-to-date fiscal 2022.

According to

Non-GAAP Impact of Deconversion Fees, Acquisitions and Divestitures

The table below is our revenue and operating income (in thousands) for the three and six months ended

|

Three Months Ended |

% Change |

Six Months Ended |

% Change |

||||||||

|

(Unaudited, in thousands) |

2021 |

2020 |

2021 |

2020 |

|||||||

|

Revenue (GAAP) |

$ 493,896 |

$ 422,361 |

17 % |

$ 981,952 |

$ 874,161 |

12% |

|||||

|

Adjustments: |

|||||||||||

|

Deconversion fee revenue |

(26,903) |

(2,155) |

(30,627) |

(8,037) |

|||||||

|

Revenue from acquisitions and divestitures |

(96) |

— |

(202) |

(1,182) |

|||||||

|

NON-GAAP ADJUSTED REVENUE |

$ 466,897 |

$ 420,206 |

11 % |

$ 951,123 |

$ 864,942 |

10% |

|||||

|

Operating income (GAAP) |

$ 125,662 |

$ 93,632 |

34 % |

$ 259,257 |

$ 211,220 |

23% |

|||||

|

Adjustments: |

|||||||||||

|

Operating income from deconversion fees* |

(24,356) |

(1,919) |

(27,540) |

(7,138) |

|||||||

|

Operating (income)/loss from acquisitions, |

21 |

(2,040) |

66 |

(2,409) |

|||||||

|

NON-GAAP ADJUSTED OPERATING INCOME |

$ 101,327 |

$ 89,673 |

13 % |

$ 231,783 |

$ 201,673 |

15% |

|||||

|

* For the fiscal quarters ended |

The tables below are the segment breakdown of revenue and cost of revenue for each period presented, as adjusted for the items above, and include a reconciliation to non-GAAP adjusted operating income presented above.

|

Three Months Ended |

|||||||||

|

(Unaudited, in thousands) |

Core |

Payments |

Complementary |

Corporate |

Total |

||||

|

REVENUE (GAAP) |

$ 154,878 |

$ 182,528 |

$ 141,724 |

$ 14,766 |

$ 493,896 |

||||

|

Deconversion fees |

(10,853) |

(7,933) |

(7,917) |

(200) |

(26,903) |

||||

|

Revenue from acquisitions and divestitures |

— |

— |

(96) |

— |

(96) |

||||

|

NON-GAAP ADJUSTED REVENUE |

144,025 |

174,595 |

133,711 |

14,566 |

466,897 |

||||

|

COST OF REVENUE |

64,554 |

95,570 |

58,151 |

64,550 |

282,825 |

||||

|

Non-GAAP adjustments |

(617) |

(244) |

(487) |

(320) |

(1,668) |

||||

|

NON-GAAP ADJUSTED COST OF REVENUE |

63,937 |

95,326 |

57,664 |

64,230 |

281,157 |

||||

|

NON-GAAP ADJUSTED SEGMENT INCOME |

$ 80,088 |

$ 79,269 |

$ 76,047 |

$ (49,664) |

|||||

|

Research and development |

29,916 |

||||||||

|

Selling, general, and administrative |

55,493 |

||||||||

|

Non-GAAP adjustments unassigned to a segment |

(996) |

||||||||

|

NON-GAAP TOTAL ADJUSTED OPERATING EXPENSES |

365,570 |

||||||||

|

NON-GAAP ADJUSTED OPERATING INCOME |

$ 101,327 |

||||||||

|

Three Months Ended |

|||||||||

|

(Unaudited, in thousands) |

Core |

Payments |

Complementary |

Corporate |

Total |

||||

|

REVENUE (GAAP) |

$ 134,948 |

$ 155,182 |

$ 121,408 |

$ 10,823 |

$ 422,361 |

||||

|

Deconversion fees |

(882) |

(674) |

(509) |

(90) |

(2,155) |

||||

|

Revenue from acquisitions and divestitures |

— |

— |

— |

— |

— |

||||

|

NON-GAAP ADJUSTED REVENUE |

134,066 |

154,508 |

120,899 |

10,733 |

420,206 |

||||

|

COST OF REVENUE |

58,485 |

86,455 |

52,407 |

60,435 |

257,782 |

||||

|

Non-GAAP adjustments |

(108) |

(24) |

(73) |

(8) |

(213) |

||||

|

NON-GAAP ADJUSTED COST OF REVENUE |

58,377 |

86,431 |

52,334 |

60,427 |

257,569 |

||||

|

NON-GAAP ADJUSTED SEGMENT INCOME |

$ 75,689 |

$ 68,077 |

$ 68,565 |

$ (49,694) |

|||||

|

Research and development |

26,780 |

||||||||

|

Selling, general, and administrative |

44,167 |

||||||||

|

Non-GAAP adjustments unassigned to a segment |

2,017 |

||||||||

|

NON-GAAP TOTAL ADJUSTED OPERATING EXPENSES |

330,533 |

||||||||

|

NON-GAAP ADJUSTED OPERATING INCOME |

$ 89,673 |

||||||||

|

Six Months Ended |

|||||||||

|

(Unaudited, In Thousands) |

Core |

Payments |

Complementary |

Corporate |

Total |

||||

|

REVENUE (GAAP) |

$ 320,163 |

$ 352,150 |

$ 283,205 |

$ 26,434 |

$ 981,952 |

||||

|

Deconversion fees |

(13,021) |

(8,381) |

(9,014) |

(211) |

(30,627) |

||||

|

Revenue from acquisitions and divestitures |

— |

— |

(202) |

— |

(202) |

||||

|

NON-GAAP ADJUSTED REVENUE |

307,142 |

343,769 |

273,989 |

26,223 |

951,123 |

||||

|

COST OF REVENUE |

131,456 |

188,795 |

113,635 |

125,574 |

559,460 |

||||

|

Non-GAAP adjustments |

(755) |

(289) |

(729) |

(321) |

(2,094) |

||||

|

NON-GAAP ADJUSTED COST OF REVENUE |

130,701 |

188,506 |

112,906 |

125,253 |

557,366 |

||||

|

NON-GAAP ADJUSTED SEGMENT INCOME |

$ 176,441 |

$ 155,263 |

$ 161,083 |

$ (99,030) |

|||||

|

Research and Development |

56,670 |

||||||||

|

Selling, General, and Administrative |

106,565 |

||||||||

|

Non-GAAP adjustments unassigned to a segment |

(1,261) |

||||||||

|

NON-GAAP TOTAL ADJUSTED OPERATING EXPENSES |

719,340 |

||||||||

|

NON-GAAP ADJUSTED OPERATING INCOME |

$ 231,783 |

||||||||

|

Six Months Ended |

|||||||||

|

(Unaudited, In Thousands) |

Core |

Payments |

Complementary |

Corporate |

Total |

||||

|

REVENUE (GAAP) |

$ 288,103 |

$ 311,915 |

$ 251,762 |

$ 22,381 |

$ 874,161 |

||||

|

Deconversion fees |

(2,934) |

(2,521) |

(2,509) |

(73) |

(8,037) |

||||

|

Revenue from acquisitions and divestitures |

(1,182) |

— |

— |

— |

(1,182) |

||||

|

NON-GAAP ADJUSTED REVENUE |

283,987 |

309,394 |

249,253 |

22,308 |

864,942 |

||||

|

COST OF REVENUE |

122,347 |

172,783 |

104,431 |

121,150 |

520,711 |

||||

|

Non-GAAP adjustments |

(902) |

(85) |

(253) |

(46) |

(1,286) |

||||

|

NON-GAAP ADJUSTED COST OF REVENUE |

121,445 |

172,698 |

104,178 |

121,104 |

519,425 |

||||

|

NON-GAAP ADJUSTED SEGMENT INCOME |

$ 162,542 |

$ 136,696 |

$ 145,075 |

$ (98,796) |

|||||

|

Research and Development |

52,837 |

||||||||

|

Selling, General, and Administrative |

89,393 |

||||||||

|

Non-GAAP adjustments unassigned to a segment |

1,614 |

||||||||

|

NON-GAAP TOTAL ADJUSTED OPERATING EXPENSES |

663,269 |

||||||||

|

NON-GAAP ADJUSTED OPERATING INCOME |

$ 201,673 |

||||||||

The table below is our GAAP to non-GAAP guidance for fiscal 2022. Non-GAAP guidance excludes the impacts of deconversion fee and acquisition and divestiture revenue (see Use of Non-GAAP Financial Information below).

|

GAAP to Non-GAAP GUIDANCE (in millions, except per share data) |

Annual FY22 |

||||

|

Low |

High |

||||

|

REVENUE (GAAP) |

$ 1,939 |

$ 1,942 |

|||

|

Growth |

10.3 % |

10.5 % |

|||

|

Deconversion fee, acquisition and divestiture revenue |

50 |

50 |

|||

|

NON-GAAP ADJUSTED REVENUE |

$ 1,889 |

$ 1,892 |

|||

|

Non-GAAP adjusted growth |

8.8 % |

9.0 % |

|||

|

EPS (GAAP) |

$ 4.75 |

$ 4.82 |

|||

|

Growth |

15.3 % |

17.0 % |

|||

Balance Sheet and Cash Flow Review

- At

December 31, 2021 , cash and cash equivalents decreased to$29.1 million from$147.8 million atDecember 31, 2020 .** - Trade receivables totaled

$236.1 million atDecember 31, 2021 compared to$212.9 million atDecember 31, 2020 . - The Company had

$240 million of borrowings atDecember 31, 2021 and no borrowings atDecember 31, 2020 .** - Total deferred revenue increased to

$275.8 million atDecember 31, 2021 , compared to$262.9 million a year ago. - Stockholders' equity decreased to

$1,272.0 million atDecember 31, 2021 , compared to$1,545.2 million a year ago.**

|

* |

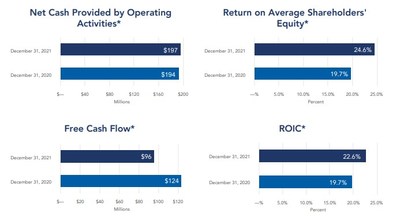

See tables on page 7 for Net Cash Provided by Operating Activities and on page 11 for Return on Average Shareholders' Equity. Tables reconciling the non-GAAP measures Free Cash Flow and Return on |

|

** |

The changes in cash and cash equivalents, borrowings and stockholders' equity, quarter over quarter, were primarily due to the Company's repurchases of common stock during fiscal 2022. |

The following table summarizes net cash from operating activities (Unaudited, in thousands):

|

Six Months Ended |

|||

|

2021 |

2020 |

||

|

Net income |

$ 197,783 |

$ 163,198 |

|

|

Depreciation |

25,843 |

26,652 |

|

|

Amortization |

62,610 |

61,164 |

|

|

Change in deferred income taxes |

11,573 |

8,651 |

|

|

Other non-cash expenses |

13,267 |

7,733 |

|

|

Change in receivables |

70,468 |

87,518 |

|

|

Change in deferred revenue |

(119,822) |

(126,134) |

|

|

Change in other assets and liabilities |

(64,371) |

(34,798) |

|

|

NET CASH PROVIDED BY OPERATING ACTIVITIES |

$ 197,351 |

$ 193,984 |

|

The following table summarizes net cash from investing activities (Unaudited, in thousands):

|

Six Months Ended |

|||

|

2021 |

2020 |

||

|

Capital expenditures |

$ (22,373) |

$ (9,543) |

|

|

Proceeds from dispositions |

38 |

6,157 |

|

|

Purchased software |

(7,364) |

(4,254) |

|

|

Computer software developed |

(71,353) |

(62,804) |

|

|

Purchase of investments |

— |

(12,100) |

|

|

NET CASH FROM INVESTING ACTIVITIES |

$ (101,052) |

$ (82,544) |

|

The following table summarizes net cash from financing activities (Unaudited, in thousands):

|

Six Months Ended |

|||

|

2021 |

2020 |

||

|

Borrowings on credit facilities* |

$ 220,000 |

$ — |

|

|

Repayments on credit facilities and financing leases |

(80,065) |

(57) |

|

|

Purchase of treasury stock* |

(193,917) |

(109,899) |

|

|

Dividends paid |

(67,696) |

(65,516) |

|

|

Net cash from issuance of stock and tax related to stock-based compensation |

3,507 |

(1,551) |

|

|

NET CASH FROM FINANCING ACTIVITIES |

$ (118,171) |

$ (177,023) |

|

|

* |

For the six months ended |

Use of Non-GAAP Financial Information

Generally Accepted Accounting Principles (GAAP) is the term used to refer to the standard framework of guidelines for financial accounting in

We believe non-GAAP financial measures help investors better understand the underlying fundamentals and true operations of our business. The non-GAAP financial measures adjusted revenue, adjusted operating income, adjusted segment income, adjusted cost of revenue, and adjusted operating expenses presented eliminate one-time deconversion fees, acquisitions and divestitures, and gain/loss, all of which management believes are not indicative of the Company's operating performance. Such adjustments give investors further insight into our performance. Non-GAAP EBITDA is defined as net income attributable to the Company before the effect of interest expense, taxes, depreciation, and amortization, adjusted for net income before the effect of interest expense, taxes, depreciation, and amortization attributable to eliminated one-time deconversion fees, acquisitions and divestitures, and gain/loss. Free cash flow is defined as net cash from operating activities, less capitalized expenditures, internal use software, and capitalized software, plus proceeds from the sale of assets. ROIC is defined as net income divided by average invested capital, which is the average of beginning and ending long-term debt and stockholders' equity for a given period. Management believes that non-GAAP EBITDA is an important measure of the Company's overall operating performance and excludes certain costs and other transactions that management deems one time or non-operational in nature; free cash flow is useful to measure the funds generated in a given period that are available for debt service requirements and strategic capital decisions; and ROIC is a measure of the Company's allocation efficiency and effectiveness of its invested capital. For these reasons, management also uses these non-GAAP financial measures in its assessment and management of the Company's performance.

Non-GAAP financial measures used by the Company may not be comparable to similarly titled non-GAAP measures used by other companies. Non-GAAP financial measures have no standardized meaning prescribed by GAAP and therefore, are unlikely to be comparable with calculations of similar measures for other companies.

Any non-GAAP financial measures should be considered in context with the GAAP financial presentation and should not be considered in isolation or as a substitute for GAAP financial measures. Reconciliations of the non-GAAP financial measures to related GAAP financial measures are included.

COVID-19 Impact and Response

Since its outbreak in early calendar 2020, COVID-19 has rapidly spread and continues to represent a public health concern. The health, safety, and well-being of our employees and customers is of paramount importance to us. In

Customers

We work closely with our customers who are scheduled for on-site visits to ensure their needs are met while taking necessary safety precautions when our employees are required to be at a customer site. Delays of customer system installations due to COVID-19 have been limited, and we have developed processes to handle remote installations when available. We expect these processes to provide flexibility and value both during and after the COVID-19 pandemic. Even though a substantial portion of our workforce has worked remotely during the outbreak and business travel has been limited, we have not yet experienced significant disruption to our operations. We believe our technological capabilities are well positioned to allow our employees to work remotely without materially impacting our business.

Financial impact

Despite the changes and restrictions caused by COVID-19, the overall financial and operational impact on our business has been limited and our liquidity, balance sheet, and business trends remain strong. We experienced positive operating cash flows during fiscal 2021 and the first six months of fiscal 2022, and we do not expect that to change in the near term. However, we are unable to accurately predict the future impact of COVID-19 due to a number of uncertainties, including further government actions; the duration, severity and recurrence of the outbreak, including the onset of variants of the virus; the effectiveness of vaccines against new variants; the development and effectiveness of treatments; the effect on the economy generally; the potential impact to our customers, vendors, and employees; and how the potential impact might affect future customer services, processing and installation-related revenue, and processes and efficiencies within the Company directly or indirectly impacting financial results. We will continue to monitor COVID-19 and its possible impact on the Company and to take steps necessary to protect the health and safety of our employees and customers.

About

Statements made in this news release that are not historical facts are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Because forward-looking statements relate to the future, they are subject to inherent risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Such risks and uncertainties include, but are not limited to, those discussed in the Company's

Quarterly Conference Call

The Company will hold a conference call on

For More Information

To directly access the Company's press releases, go to ir.jackhenry.com/press-releases.

|

Condensed Consolidated Statements of Income |

% Change |

% Change |

|||||||||

|

Three Months Ended |

Six Months Ended |

||||||||||

|

(Unaudited, in thousands, except per share data) |

2021 |

2020 |

2021 |

2020 |

|||||||

|

REVENUE |

$ 493,896 |

$ 422,361 |

17% |

$ 981,952 |

$ 874,161 |

12% |

|||||

|

Cost of revenue |

282,825 |

257,782 |

10% |

559,460 |

520,711 |

7% |

|||||

|

Research and development |

29,916 |

26,780 |

12% |

56,670 |

52,837 |

7% |

|||||

|

Selling, general, and administrative |

55,493 |

44,167 |

26% |

106,565 |

89,393 |

19% |

|||||

|

EXPENSES |

368,234 |

328,729 |

12% |

722,695 |

662,941 |

9% |

|||||

|

OPERATING INCOME |

125,662 |

93,632 |

34% |

259,257 |

211,220 |

23% |

|||||

|

Interest income |

6 |

52 |

(88)% |

13 |

120 |

(89)% |

|||||

|

Interest expense |

(447) |

(117) |

282% |

(696) |

(235) |

196% |

|||||

|

Interest income (expense) |

(441) |

(65) |

578% |

(683) |

(115) |

494% |

|||||

|

INCOME BEFORE INCOME TAXES |

125,221 |

93,567 |

34% |

258,574 |

211,105 |

22% |

|||||

|

Provision for income taxes |

29,551 |

21,585 |

37% |

60,791 |

47,907 |

27% |

|||||

|

NET INCOME |

$ 95,670 |

$ 71,982 |

33% |

$ 197,783 |

$ 163,198 |

21% |

|||||

|

Diluted net income per share |

$ 1.30 |

$ 0.94 |

$ 2.68 |

$ 2.13 |

|||||||

|

Diluted weighted average shares outstanding |

73,697 |

76,280 |

73,920 |

76,496 |

|||||||

|

Condensed Consolidated Balance Sheet Highlights |

|||||||||||

|

|

|||||||||||

|

(Unaudited, in thousands) |

2021 |

2020 |

|||||||||

|

Cash and cash equivalents |

$ 29,120 |

$ 147,762 |

|||||||||

|

Receivables |

236,096 |

212,934 |

|||||||||

|

Total assets |

2,280,802 |

2,286,709 |

|||||||||

|

Accounts payable and accrued expenses |

$ 164,518 |

$ 157,447 |

|||||||||

|

Current and long-term debt |

240,129 |

266 |

|||||||||

|

Deferred revenue |

275,778 |

262,883 |

|||||||||

|

Stockholders' equity |

1,271,996 |

1,545,179 |

|||||||||

|

Calculation of Non-GAAP Earnings Before Income Taxes, Depreciation and Amortization (Non-GAAP EBITDA) |

|||||||||||

|

Three Months Ended |

% Change |

Six Months Ended |

% Change |

||||||||

|

(in thousands) |

2021 |

2020 |

2021 |

2020 |

|||||||

|

Net income |

$ 95,670 |

$ 71,982 |

$ 197,783 |

$ 163,198 |

|||||||

|

Interest expense |

447 |

117 |

696 |

235 |

|||||||

|

Taxes |

29,551 |

21,585 |

60,791 |

47,907 |

|||||||

|

Depreciation and amortization |

44,280 |

44,073 |

88,453 |

87,816 |

|||||||

|

Less: Net income before interest expense, taxes, depreciation and amortization attributable to eliminated one-time deconversions, acquisitions and divestitures, and gain/loss |

(24,352) |

(3,959) |

(27,509) |

(9,905) |

|||||||

|

NON-GAAP EBITDA |

$ 145,596 |

$ 133,798 |

9% |

$ 320,214 |

$ 289,251 |

11% |

|||||

|

Calculation of Free Cash Flow (Non-GAAP) |

|||||||||||

|

Six Months Ended |

|||||||||||

|

(in thousands) |

2021 |

2020 |

|||||||||

|

Net cash from operating activities |

$ 197,351 |

$ 193,984 |

|||||||||

|

Capitalized expenditures |

(22,373) |

(9,543) |

|||||||||

|

Internal use software |

(7,364) |

(4,254) |

|||||||||

|

Proceeds from sale of assets |

38 |

6,157 |

|||||||||

|

Capitalized software |

(71,353) |

(62,804) |

|||||||||

|

FREE CASH FLOW |

$ 96,299 |

$ 123,540 |

|||||||||

|

Calculation of the Return on Average Shareholders' Equity |

|||||||||||

|

|

|||||||||||

|

(in thousands) |

2021 |

2020 |

|||||||||

|

Net income (trailing four quarters) |

$ 346,055 |

$ 298,397 |

|||||||||

|

Average stockholder's equity (period ending balances) |

1,408,588 |

1,515,963 |

|||||||||

|

RETURN ON AVERAGE SHAREHOLDERS' EQUITY |

24.6% |

19.7% |

|||||||||

|

Calculation of Return on |

|||||||||||

|

|

|||||||||||

|

(in thousands) |

2021 |

2020 |

|||||||||

|

Net income (trailing four quarters) |

$ 346,055 |

$ 298,397 |

|||||||||

|

Average stockholder's equity (period ending balances) |

1,408,588 |

1,515,963 |

|||||||||

|

Average current maturities of long-term debt (period ending balances) |

110 |

59 |

|||||||||

|

Average long-term debt (period ending balances) |

120,088 |

75 |

|||||||||

|

Average invested capital |

|

$ 1,516,097 |

|||||||||

|

ROIC |

22.6% |

19.7% |

|||||||||

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/jack-henry--associates-inc-reports-second-quarter-fiscal-2022-results-301478090.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/jack-henry--associates-inc-reports-second-quarter-fiscal-2022-results-301478090.html

SOURCE

MEDIA CONTACT - Mark Folk, Corporate Communications, Jack Henry & Associates, Inc., 704-890-5323, MFolk@jackhenry.com; ANALYST CONTACT - Vance Sherard, CFA, Investor Relations, Jack Henry & Associates, Inc., 417-235-6652, VSherard@jackhenry.com